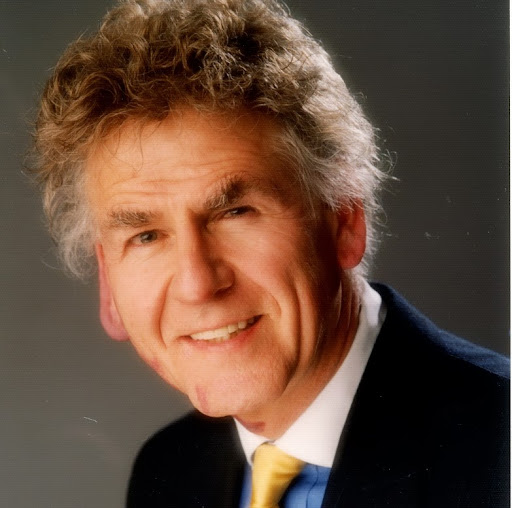

Arthur H Boelter

Deceased

from Chicago, IL

- Also known as:

-

- Arthur B Boelter

- Elizabeth Wagner

- Phone and address:

- 1222 W Newport Ave, Chicago, IL 60657

Arthur Boelter Phones & Addresses

- 1222 W Newport Ave, Chicago, IL 60657

- 7830 56Th St, Seattle, WA 98115 • (206)5244824

- 7830 56Th Pl NE, Seattle, WA 98115 • (509)2647198

Work

-

Company:Boelter & associates

-

Position:Attorney

Education

-

Degree:JD

-

School / High School:New York University School of Law

Ranks

-

Licence:Washington - Active

-

Date:1979

Emails

Industries

Law Practice

Resumes

Attorney

view sourceLocation:

Seattle, WA

Industry:

Law Practice

Work:

Boelter & Associates

Attorney

Attorney

Lawyers & Attorneys

Arthur H. Boelter, Seattle WA - Lawyer

view sourceAddress:

Boelter & Associates

121 Lakeside Ave Suite 100, Seattle, WA 98122

(206)5870000 (Office), (206)8384956 (Fax)

121 Lakeside Ave Suite 100, Seattle, WA 98122

(206)5870000 (Office), (206)8384956 (Fax)

Licenses:

Washington - Active 1979

Illinois - Not Authorized To Practice Law 1973

Illinois - Not Authorized To Practice Law 1973

Education:

New York University School of Law

Degree - JD

DePaul University College of Law

Degree - JD

Degree - JD

DePaul University College of Law

Degree - JD

Specialties:

Tax - 50%

Estate Planning - 50%

Estate Planning - 50%

Arthur Boelter, Seattle WA - Lawyer

view sourceAddress:

1411 4Th Ave, Seattle, WA 98101

Phone:

(206)5870000 (Phone), (206)8384956 (Fax)

Experience:

46 years

Specialties:

Bankruptcy

Estate Planning

Tax Law

Estate Planning

Tax Law

Jurisdiction:

Washington (1979)

Memberships:

Washington State Bar (1979)

Links:

Website

Name / Title

Company / Classification

Phones & Addresses

Owner

Boelter & Associates

Boelter & Association

Attorneys

Boelter & Association

Attorneys

1411 4Th Ave STE 1410, Seattle, WA 98101

(206)5870000

(206)5870000

Owner

Boelter & Associates

Attorneys

Attorneys

1411 4 Ave STE 1410, Seattle, WA 98101

(206)5870000

(206)5870000

Owner

Boelter & Co

All Other Miscellaneous Store Retailers (except Tobacco Stor

All Other Miscellaneous Store Retailers (except Tobacco Stor

1411 4 Ave STE 1410, Seattle, WA 98101

(206)5870000

(206)5870000

ALL Officers

ARTHUR H. BOELTER, P.S., INC

1001 4 Ave #4111, Seattle, WA 98154

Owner

Boelter & Assoc

Ret Misc Merchandise Legal Services Office

Ret Misc Merchandise Legal Services Office

1411 4 Ave, Seattle, WA 98101

(206)5870000

(206)5870000

Secretary

Vac Buddy, Inc

1411 2 Ave, Seattle, WA 98101

1410 1411 4 Ave, Seattle, WA 98101

14407 2 Ave SW, Seattle, WA 98166

1411-4 Ave STE 1410, Seattle, WA 98101

1410 1411 4 Ave, Seattle, WA 98101

14407 2 Ave SW, Seattle, WA 98166

1411-4 Ave STE 1410, Seattle, WA 98101

Secretary

Lark Specialties, Inc

Nonclassifiable Establishments

Nonclassifiable Establishments

1411 4 Ave, Seattle, WA 98101

Googleplus

Arthur Boelter

Lived:

Seattle, WA

Work:

Boelter & Associates - Principal (2013)

Education:

New York University School of Law - Taxation, DePaul University College of Law, University of Illinois

About:

Representing taxpayers for over 30 years, he still relies heavily on his insights into IRS procedures and decision-making to counter the government. Having resolved thousands of tax-related cases, Art...

Tagline:

Specializing in: Bankruptcy Law, Litigation & Appeals, Wills, Tax Disputes, Tax Controversies, Retaining Wealth, IRS Audits and Investigations, Offshore Tax Regulations, International Tax Laws, Collections & Repossessions, Tax Litigation, Estate & Gift Taxation, Estate Planning, International Taxation

Bragging Rights:

Author of: Tax Preparer Penalties and Circular 230 Enforcement, Representing the Bankrupt Taxpayer, Tax Penalties and Interest, and Representation Before the Appeals Division of the IRS. Co-author of Mertens Law of Federal Income Taxation.

Classmates

Lane Technical High Schoo...

view sourceGraduates:

Tracie Jackson (1988-1992),

Denzil Rodrigues (2001-2005),

Arthur Boelter (1959-1963),

Nathan Schustek (1991-1995)

Denzil Rodrigues (2001-2005),

Arthur Boelter (1959-1963),

Nathan Schustek (1991-1995)

Youtube

Get Report for Arthur H Boelter from Chicago, ILDeceased