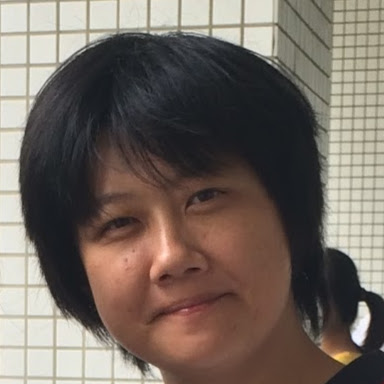

Jin Zhou Lin

age ~67

from Apex, NC

- Also known as:

-

- Lin Jin Zhou

- Lin J Zhou

- Lin Xiao Zhou

- Lin Jin Zhon

- Linjin J Zhou

- Jin Zhou Linjin

- Lijun Zhou

- Jun Zhou Li

Jin Lin Phones & Addresses

- Apex, NC

- Keene, NH

- East Brunswick, NJ

- Flushing, NY

- Jamaica, NY

Real Estate Brokers

Jin Lin, Flushing NY

view sourceSpecialties:

Buyer's Agent

Listing Agent

Commercial R.E.

Property Management

Listing Agent

Commercial R.E.

Property Management

Work:

Top Real Estate and Management

6127 136Th St, Flushing, NY 11367

(917)5959759 (Office)

6127 136Th St, Flushing, NY 11367

(917)5959759 (Office)

Languages:

Mandarin

Cantonese

Cantonese

License Records

Jin Lin

Address:

Flushing, NY 11355

License #:

004422 - Expired

Category:

Cosmetology

Type:

Nail Technician Temp Auth to Practice

Lawyers & Attorneys

Resumes

Jin Lin Elmhurst, NY

view sourceWork:

China One Restaurant

Jul 2009 to Jan 2012 Sakura Japan

Jun 2008 to Sep 2008

cashier/sample boy Foung Lin Construction

Jul 2007 to Sep 2007

Construction worker Ping's

Jun 2006 to Sep 2006

waiter/busboy

Jul 2009 to Jan 2012 Sakura Japan

Jun 2008 to Sep 2008

cashier/sample boy Foung Lin Construction

Jul 2007 to Sep 2007

Construction worker Ping's

Jun 2006 to Sep 2006

waiter/busboy

Education:

Queens Community College

Aug 2009

Business Associate Queens College

Accounting

Aug 2009

Business Associate Queens College

Accounting

Jin Lin Brooklyn, NY

view sourceWork:

TheAve Inc

New York, NY

Jun 2011 to Feb 2013

Web developer Stony Brook University

Sep 2010 to May 2012

Lab Assistant -Work Study Workplaces Stars

Dec 2010 to Mar 2011

Intern -Software engineer Spring - Arup

2008 to Dec 2009

Intern - Architect Young Dancers in Repertory

Brooklyn, NY

Jun 2008 to Aug 2008

Teaching Assistant Garden City Restaurant

2006 to 2007

Waiter

New York, NY

Jun 2011 to Feb 2013

Web developer Stony Brook University

Sep 2010 to May 2012

Lab Assistant -Work Study Workplaces Stars

Dec 2010 to Mar 2011

Intern -Software engineer Spring - Arup

2008 to Dec 2009

Intern - Architect Young Dancers in Repertory

Brooklyn, NY

Jun 2008 to Aug 2008

Teaching Assistant Garden City Restaurant

2006 to 2007

Waiter

Education:

Stony Brook University

Stony Brook, NY

2012

BS in Computer Science And Applied Math Statistics

Stony Brook, NY

2012

BS in Computer Science And Applied Math Statistics

Skills:

Java ,J2EE , MySQL/HQL , HTML/CSS ,Ruby,RESTFUL,C/C++ ,Js/Ajax/JQuery/Backbone ,Data structure, Algorithm , Android/IOS , Photoshop, Finite Mathmatics, Probablity Thoery

Name / Title

Company / Classification

Phones & Addresses

Chief Executive

Venus Realty

Surety Insurance

Surety Insurance

8012 88Th Rd, Jamaica, NY 11421

Information Technology Manager

Natural Source International, Ltd.

Groceries and Related Products

Groceries and Related Products

150 E 55Th St Fl 2, New York, NY 10022

President

King Chef Restaurant Inc

5123 65 St, Flushing, NY 11377

Owner

Mister Lin's Chinese Kitchen

Eating Place

Eating Place

11021 Jamaica Ave, Jamaica, NY 11418

President

GREEN HILL TEA CORPORATION

Whol Groceries

Whol Groceries

342 Broadway #288, New York, NY 10013

(347)4231963

(347)4231963

President

ZHUO SHANG LIN RESTAURANT INC

1757 Elizabeth Pike, Mineral Wells, WV 26150

32 E Broadway RM 401, New York, NY 10002

32 E Broadway RM 401, New York, NY 10002

Principal

Butterfly 2 Chinese Rest

Eating Place

Eating Place

145109 Guy R Brewer Blvd, Jamaica, NY 11434

Principal

Hunan East Restaurant

Eating Place

Eating Place

192 Main St, Ridgefield Park, NJ 07660

Us Patents

-

Co-Browsing System Including Form And Focal-Point Synchronization Capabilities For Both Secure And Non-Secure Web Documents

view source -

US Patent:20030061286, Mar 27, 2003

-

Filed:Sep 27, 2001

-

Appl. No.:09/966682

-

Inventors:Jin Lin - Chapel Hill NC, US

-

International Classification:G06F015/16

-

US Classification:709/205000, 715/501100, 709/218000

-

Abstract:Described are a system and its methods for extending the web co-browsing functions of both secure and non-secure web pages. The extension includes form synchronization and focal-point synchronization. Focal-point synchronization is accomplished using a shared pointer and page scrolling. To provide these functions for both non-secure and secure web pages without breaking the security models of web browsers, two control applets, one in a non-secure frame and the other in a secure frame, are downloaded to the web browser of a conference participant. The control applets function as control and communication gateways for shared HTTP and HTTPS pages. Form synchronization is accomplished by detecting update events of form elements. Focal-point synchronization is achieved by adding mouse click events to embedded images or hyperlinks in web pages. These events are then decoded by the control applets and sent to a co-browse server. The co-browse server notifies other users' control applets to update the form data, to change the location of the shared pointer, or to scroll the displayed page to a common focal point.

Vehicle Records

-

Jin Lin

view source -

Address:5725 156 St, Flushing, NY 11355

-

VIN:JTJBT20X970140788

-

Make:LEXUS

-

Model:GX 470

-

Year:2007

Plaxo

Jin Lin

view sourceArbonne International

Myspace

Flickr

Jin Hui Lin

view source

Jin Jin Lin

view source

Chg Jin Lin

view source

Jin Yun Lin

view source

Jin Lhong Lin

view source

Jin Hai Lin

view source

Zachary Kew Jin Lin

view source

Jin Lin

view sourceClassmates

Jin Lin

view sourceSchools:

Cowper School Intermediate School 73 Maspeth NY 1994-1997

Community:

Bobbye Jackson, William Cohen, Diana Thompson

Jin Lin

view sourceSchools:

Livingston Middle School Albany NY 1996-2000

Community:

Shanea Singleton, Ann Wagenknecht, Joe Leigh, Elizabeth Thornton, Dayshawn Jones, Elizabeth Redmon, Devon Gaddy, Keyona Lewis, Alex Lopez, Anthony Ervin

Livingston Middle School,...

view sourceGraduates:

Aretha Barnes (1981-1983),

William McKern (1976-1977),

Keyona Lewis (1992-1996),

Talisha Allen (2001-2005),

Jin Lin (1996-2000)

William McKern (1976-1977),

Keyona Lewis (1992-1996),

Talisha Allen (2001-2005),

Jin Lin (1996-2000)

Neptune High School, Nept...

view sourceGraduates:

Leeanne Carpenter (1967-1971),

Patricia Bell (1978-1982),

James Davis (1977-1981),

Jin Lin (1998-2002),

Carmelo Gonzalez (1981-1985)

Patricia Bell (1978-1982),

James Davis (1977-1981),

Jin Lin (1998-2002),

Carmelo Gonzalez (1981-1985)

Cowper School Intermediat...

view sourceGraduates:

Jin Lin (1994-1997),

Peter Chao (1985-1989),

Valerie Tovar (1998-2002),

Terry Schwartz (1964-1967),

Nancy Patricia Diaz (1976-1978)

Peter Chao (1985-1989),

Valerie Tovar (1998-2002),

Terry Schwartz (1964-1967),

Nancy Patricia Diaz (1976-1978)

Canton High School, Canto...

view sourceGraduates:

Cinda Davidson (1970-1974),

A Jin Lin (1998-2002),

Jeff Bergstralh (1989-1993),

Marcy McIntire (1981-1985)

A Jin Lin (1998-2002),

Jeff Bergstralh (1989-1993),

Marcy McIntire (1981-1985)

Googleplus

Jin Lin

Bragging Rights:

高中班導師說要記我小過,很瀟灑的說:「記吧,我沒差。」,於是小過Get!

Jin Lin

Jin Lin

Education:

Neptune High School

Jin Lin

Work:

Ssmc - Technician

Relationship:

Engaged

Jin Lin

Jin Lin

Relationship:

Married

Jin Lin

About:

Jin

Jin Lin

Youtube

News

ICBC Profit Growth Slows But Outlook is Upbeat

view source- The rise in net-interest margin was probably because lenders managed to keep deposit rates under control while not extending favorable-rate loans at a time of an economic slowdown, said Jin Lin, an analyst with Orient Securities. By doing so, banks are able to keep net-interest margin at a healthy

- Date: Mar 28, 2013

- Category: Business

- Source: Google

CCB Profit Rises 14%, Weakest Since 2006

view source- "It's inevitable that banks' profit growth slows, given the interest-rate liberalization would hurt their net-interest margin," a primary gauge of banks' lending profitability, said Orient Securities analyst Jin Lin.

- Date: Mar 24, 2013

- Category: Business

- Source: Google

China's Stocks Rise on Factory Growth, Paring Weekly Loss; Air China Gains

view source- Net interest margin growth may slow in the second quarteras rising costs of deposits would erode yields on lending, Jin Lin, a banking analyst at Orient Securities in Shanghai, said byphone. Banks are under pressure to lure deposits to meet dailyloan-to-deposit ratios.

- Date: Apr 29, 2011

- Category: Business

- Source: Google

Get Report for Jin Zhou Lin from Apex, NC, age ~67