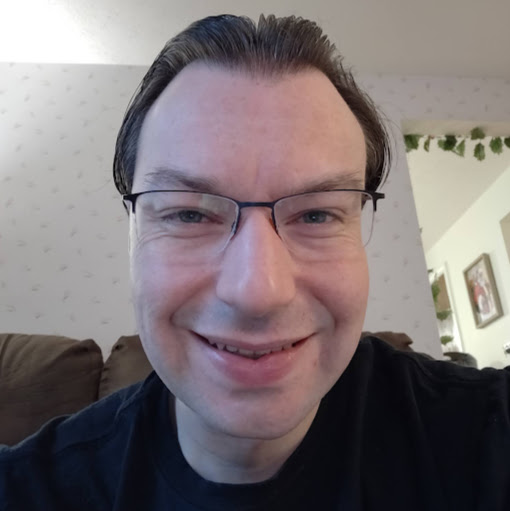

Michael S Symonds

age ~65

from Riverside, CA

- Also known as:

-

- Michael Shannon Symonds

- Michael R Hunt

- Mike S Symonds

- Michael S

- Alesha Conner

- Phone and address:

-

11005 Campbell Ave, Riverside, CA 92505

(951)3434167

Michael Symonds Phones & Addresses

- 11005 Campbell Ave, Riverside, CA 92505 • (951)3434167

- 6128 Mitchell Ave, Riverside, CA 92505 • (909)3518854

- 10242 Stanford Ave, Garden Grove, CA 92840 • (503)6700323

- 9797 Garden Grove Blvd, Garden Grove, CA 92844

- Pomona, CA

- Westminster, CA

- 6263 Childs Rd, Lake Oswego, OR 97035

- Sylva, NC

Work

-

Company:Advanced solids control - Carlsbad, NM

-

Position:Driver

Education

-

School / High School:skyway trucking upland ca- Upland, CA2012

-

Specialities:none in cdl

Resumes

Vice President, Gann Global Financial

view sourcePosition:

Vice President at Gann Global Financial

Location:

Greater Los Angeles Area

Industry:

Publishing

Work:

Gann Global Financial since Sep 2001

Vice President

Gann Global Financial Feb 2004 - Dec 2007

Director of Marketing

National Institute of Investment Research Sep 2001 - Feb 2004

Customer Service Director

Vice President

Gann Global Financial Feb 2004 - Dec 2007

Director of Marketing

National Institute of Investment Research Sep 2001 - Feb 2004

Customer Service Director

Education:

Santa Monica College 1994 - 1999

AA, Liberal Arts

AA, Liberal Arts

Interests:

My family, my wife, my children, God, sports, building businesses, technology, gadgets, good food

Vice President, Gann Global Financial

view sourceLocation:

Greater Los Angeles Area

Industry:

Publishing

Michael Symonds

view sourceLocation:

United States

Michael Symonds Carlsbad, NM

view sourceWork:

advanced solids control

Carlsbad, NM

driver

Carlsbad, NM

driver

Education:

skyway trucking upland ca

Upland, CA

2012 to 2012

none in cdl none

n/a

Upland, CA

2012 to 2012

none in cdl none

n/a

Name / Title

Company / Classification

Phones & Addresses

GREAT LAKES ADVERTISING & COMMUNICATIONS, LTD

Youtube

Plaxo

Michael Symonds

view sourceUtrecht, The Netherlands

Michael Symonds

view sourceGoogleplus

Michael Symonds

Education:

Nicolas Chamberlain Technology College

Michael Symonds

Education:

San Francisco State University - Cinema Production

Michael “A 360 Lb Gorilla...

Michael Symonds

Michael Symonds

Michael Symonds

Michael Symonds

Michael Symonds

News

UCLA Discovers Weight Loss Game-Changer: Stimulating Brown Fat To Fight Obesity

view source- ouza, Julie Sorg, Dr. Harold Sacks, Dr. Michael Fishbein, Dr. Grace Chang, Dr. Warwick Peacock, Dr. Maie St. John, Dr. Olujimi Ajijola, and Dr. Kalyanam Shivkumar of UCLA; Dr. Donald Hoover of East Tennessee State University, and Dr. James Law and Dr. Michael Symonds of University of Nottingham, UK.

- Date: Oct 08, 2023

- Category: Health

- Source: Google

Co-op Bank to Raise New Capital

view source- cuts and detail of any coercive triggers, but with the restructuring of the 1.3bn layer of subordinated debt expected to contribute as much as 1bn in fresh capital, significant losses are likely for subordinated investors, said Michael Symonds, credit analyst at Daiwa Capital Markets Europe Ltd.

- Date: Jun 17, 2013

- Category: Business

- Source: Google

Regulator Says Lloyds, RBS Can Meet Capital Requirement

view source- Despite the lack of detail, the revelation that capital needs are manageable is supportive for Lloyds credit storyalbeit in line with expectations, said Michael Symonds, a banks credit analyst at Daiwa Capital Markets Europe.

- Date: May 22, 2013

- Category: Business

- Source: Google

Most Spanish banks pass stress tests

view source- tests allows Spain to cross one big hurdle but it's just the first step along a very long road to recovery. "It's what happens now. It's when the hard work begins for Spain," said Michael Symonds, credit analyst at Daiwa Capital Markets in London. "The devil will be in the details of Spain's bad bank.

- Date: Sep 28, 2012

- Category: Business

- Source: Google

Spain stocks up on hopes for near-term bank rescue

view source- Michael Symonds, credit analyst at Daiwa Capital Markets, said officials probably would like to be pre-emptive about any rescue for Spain ahead of the Greek election June 17, meaning the weekend could still produce some sort of bailout framework.

- Date: Jun 08, 2012

- Source: Google

RBS, Lloyds Cut by Moody's on Declining Government Support

view source- ssment that governments will materially reduce the level of extraordinary support on offer to their banking systems with the escalation of the sovereign and banking crisis almost certainly about to result in a broad government-backed recapitalization of the continents banks, Michael Symonds, a cred

- Date: Oct 07, 2011

- Category: World

- Source: Google

RBS, Lloyds Cut by Moody's on Declining Government Support

view source- "Moody's has pulled the trigger a little early," said Michael Symonds, a credit analyst at Daiwa Capital Markets Europe Ltd. said in a note today. "The escalation of the sovereign and banking crisis" will "result in a broad government-backed recapitalization of the continent's banks," he said.

- Date: Oct 07, 2011

- Category: Business

- Source: Google

Futures Follow European Markets Higher

view source- uropean banks from potential losses from a Greek default or larger-than-planned debt restructuring, it is essential that a sizeable and effective firebreak is created to prevent contagion to Italian and Spanish government debt if the sovereign and banking crisis is to be contained," said Michael Symonds

- Date: Oct 05, 2011

- Category: Business

- Source: Google

Get Report for Michael S Symonds from Riverside, CA, age ~65