Robert L Thibodeau

age ~93

from Gloucester, MA

- Also known as:

-

- Robert J Thibodeau

- Robert D Thibodeau

- Robt L Thibodeau

- Bob J Thibodeau

- Rob J Thibodeau

- Rober Thibodeau

- Phone and address:

-

17 Revere St, Gloucester, MA 01930

(978)2837768

Robert Thibodeau Phones & Addresses

- 17 Revere St, Gloucester, MA 01930 • (978)2837768

- Concord, NH

- 17 Revere St, Gloucester, MA 01930

Work

-

Position:Administrative Support Occupations, Including Clerical Occupations

Education

-

Degree:High school graduate or higher

Us Patents

-

Rotational Apparatus Including A Passive Magnetic Bearing

view source -

US Patent:7902706, Mar 8, 2011

-

Filed:Aug 20, 2007

-

Appl. No.:11/894400

-

Inventors:Robert J. Thibodeau - Gloucester MA, US

Christopher Williams - Manchester MA, US

Daniel Irvin - Prides Crossing MA, US -

Assignee:Maglev Technologies, LLC - Gloucester MA

-

International Classification:H02K 7/09

-

US Classification:310 905

-

Abstract:A rotational apparatus with one or more passive magnetic bearing(s) is described. The rotational apparatus includes a rotor with a tapered magnetic ring and a stator with a tapered array of shorted conducting circuits. A repulsive force between the tapered magnetic ring and the tapered array of shorted conducting circuits acts a passive magnetic bearing that centers the rotor radially in a stator cavity and that repels the rotor axially away from an end of the stator cavity.

-

Rotational Apparatus

view source -

US Patent:20060275155, Dec 7, 2006

-

Filed:Dec 5, 2005

-

Appl. No.:11/293982

-

Inventors:Robert Thibodeau - Gloucester MA, US

-

International Classification:F04B 35/04

-

US Classification:417410100

-

Abstract:Disclosed herein are apparatuses having a stator and a rotor configured to provide both a magnetic drive means and a magnetic bearing means for a rotatable element. The stator and rotor are configured to operate in unison to provide a magnetic force to rotate a rotatable element associated with the rotor about an axis and to control a radial, an axial, and a tilt position of the rotatable element about the axis. The rotor and stator assemblies are configured with complementary surface shapes to produce shapeable magnetic drive forces and shapeable magnetic bearing forces to drive and control an axial, a radial, and a tilt position of an associated rotatable element.

-

Systems And Methods For Valuing Receivables

view source -

US Patent:20070073685, Mar 29, 2007

-

Filed:Sep 26, 2005

-

Appl. No.:11/236296

-

Inventors:Robert Thibodeau - Gloucester MA, US

Thomas Halket - Larchmont NY, US -

Assignee:Robert Thibodeau - Gloucester MA

-

International Classification:G06F 17/30

-

US Classification:707006000

-

Abstract:The present invention provides systems and methods for processing receivables data, such as medical receivables, to provide the receivables as an asset with a qualified financial value for a financial services domain. The medical receivables data may include an identifier of a health care related service for which a claim for payment is requested. The present invention describes systems and methods for assigning a predictive financial value for the service identified by the claim to create an asset with a qualified financial value and to create an agreement or financial instrument to pay the qualified financial value by a payer.

-

Magnetic Composites

view source -

US Patent:20080044680, Feb 21, 2008

-

Filed:Aug 20, 2007

-

Appl. No.:11/894371

-

Inventors:Robert Thibodeau - Gloucester MA, US

Christopher Williams - Manchester MA, US

Daniel Irvin - Prides Crossing MA, US -

Assignee:Maglev Technologies, LLC - Manchester MA

-

International Classification:B22F 7/06

-

US Classification:428547000, 264427000, 264437000, 425130000, 425003000, 428539500

-

Abstract:The present invention discloses methods and magnetic material composites capable of withstanding one or more loads without the need for a substructure to provide structural support thereto. The magnetic composites are formable from composites such as epoxies, resins, plastics and the like together with rare earth or other magnetic or magnetizable compounds, or magnetic nano-particles to form structural magnetic composites. The magnetic composites have one or more portions with an aggregation of the magnetic material and one or more portions free of or substantially free of the magnetic material. The magnetic composites are suitable for use to form components of electrical motors, generators, pumps, fans, paints, coatings and parts or derivatives thereof.

-

Rotational Apparatus

view source -

US Patent:20090010785, Jan 8, 2009

-

Filed:Sep 18, 2008

-

Appl. No.:12/212771

-

Inventors:Robert J. Thibodeau - Gloucester MA, US

-

Assignee:Maglev Technologies, LLC - Manchester MA

-

International Classification:F04B 35/04

-

US Classification:4174237

-

Abstract:Disclosed herein are apparatuses having a stator and a rotor configured to provide both a magnetic drive means and a magnetic bearing means for a rotatable element. The stator and rotor are configured to operate in unison to provide a magnetic force to rotate a rotatable element associated with the rotor about an axis and to control a radial, an axial, and a tilt position of the rotatable element about the axis. The rotor and stator assemblies are configured with complementary surface shapes to produce shapeable magnetic drive forces and shapeable magnetic bearing forces to drive and control an axial, a radial, and a tilt position of an associated rotatable element.

-

System And Method For The Creation And Sale Of Sec-Compliant Investment Vehicles

view source -

US Patent:20130124432, May 16, 2013

-

Filed:Nov 2, 2012

-

Appl. No.:13/667464

-

Inventors:Mariner Ventures - Gloucester MA, US

Robert J. Thibodeau - Gloucester MA, US -

Assignee:Mariner Ventures - Gloucester MA

-

International Classification:G06Q 40/06

-

US Classification:705 36 R

-

Abstract:A system and method are disclosed for raising financing in accordance with SEC and other regulatory requirements by an early stage company. Initially, a draft business plan is presented to collaborators, on a company's Internet website, and interested potential collaborators of the company are allowed to collaborate and assist in the development and refinement of the business plan, invite other prospective collaborators likewise to collaborate on the plans development. At such point as the business plan receives enough such indications of positive interest from collaborators, the company may elect to package the business plan elements into a securities offering as may be determined suitable by the company based on the number, qualifications, and geographic locations of collaborators who have indicated a willingness and a desire to invest in the company which they have helped to create.

Resumes

Chief Of Strategy

view sourceLocation:

Boston, MA

Industry:

Electrical/Electronic Manufacturing

Work:

Free Flow Power Corporation

Chief of Strategy

Chief of Strategy

Robert Thibodeau

view source

Robert Bob Thibodeau

view source

Robert Thibodeau

view sourceWork:

Fairhope

Robert Thibodeau

view source

Robert Thibodeau

view source

Partner At Private Pulic Funds

view sourcePosition:

Partner at Private Pulic Funds

Location:

Greater Boston Area

Industry:

Capital Markets

Work:

Private Pulic Funds

Partner

Partner

License Records

Robert J Thibodeau

License #:

RS134052A - Expired

Category:

Real Estate Commission

Type:

Real Estate Salesperson-Standard

Name / Title

Company / Classification

Phones & Addresses

Director

SAIL GLOUCESTER COMMUNITY BOATING CENTER, INC

Individual/Family Services

Individual/Family Services

5 Addison St, Gloucester, MA 01930

245 E Main St, Gloucester, MA 01930

245 E Main St, Gloucester, MA 01930

Vice-President

Free Flow Power

Renewables & Environment · Developer Turbines/Generator Sets · Mfg Turbines/Generator Sets

Renewables & Environment · Developer Turbines/Generator Sets · Mfg Turbines/Generator Sets

239 Cswy St SUITE 300, Boston, MA 02114

33 Commercial St, Gloucester, MA 01930

(978)2832822

33 Commercial St, Gloucester, MA 01930

(978)2832822

Myspace

Flickr

Robert Thibodeau

view source

Robert Thibodeau

view source

Robert Louis Thibodeau

view source

Robert Thibodeau

view source

Robert Thibodeau

view source

Robert Thibodeau

view source

Robert Thibodeau

view source

James Robert Thibodeau

view sourceClassmates

Robert Thibodeau

view sourceSchools:

Sussex Regional High School Sussex NB 1960-1964

Community:

Helen Lynch, Marilyn Leblanc, Claudia Riedel

Robert Thibodeau

view sourceSchools:

Holyoke Catholic High School Granby MA 1964-1968

Community:

Linda Roy, Christine Crochetiere, Richard Stuart, Paul Hague

Robert Thibodeau

view sourceSchools:

Ecole Superieur High School Rogersville NB 1975-1979

Robert Thibodeau

view sourceSchools:

Van Buren District High School Van Buren ME 1957-1961

Community:

Marjorie Cole, Heather Deschaine, Benjamin Adams

Robert Thibodeau

view sourceSchools:

Phillips Exeter Academy Exeter NH 1976-1980

Community:

R Gowen

Robert Thibodeau

view sourceSchools:

Beekmantown High School Plattsburgh NY 1987-1991

Community:

Jerry Dufrane, Diane Owen, Diane Jennette, Robert Brinson, Kim Facteau, Matt Baker, Linda Reed, James Nephew, Lisa Drapeau, Cary Dintaman

Robert Thibodeau | Philli...

view source

Robert Thibodeau | Bellin...

view sourceGoogleplus

Robert Thibodeau

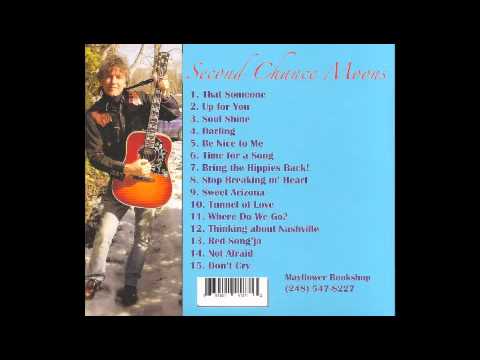

Tagline:

Singer Songwriter, astrologer, Mayflower Bookshop in Berkley Michigan

Robert Thibodeau

Tagline:

Chaleureux drole tres pentoufe

Robert Thibodeau

Robert Thibodeau

Robert Thibodeau

Robert Thibodeau

Robert Thibodeau

Robert Thibodeau

Youtube

Get Report for Robert L Thibodeau from Gloucester, MA, age ~93